Fixed Rate Mortgage

Interest Rate and payments remain the same for the entire term of the loan.

FHA Loan

Interest Rate and payments remain the same for the entire term of the loan.

VA Loan

Interest Rate and payments remain the same for the entire term of the loan.

Rehab Loan

Interest Rate and payments remain the same for the entire term of the loan.

USDA Loan

Interest Rate and payments remain the same for the entire term of the loan.

Jumbo Loan

Interest Rate and payments remain the same for the entire term of the loan.

First Time Home Buyer

Interest Rate and payments remain the same for the entire term of the loan.

Low Down Payment Options

Interest Rate and payments remain the same for the entire term of the loan.

Investment Property

Interest Rate and payments remain the same for the entire term of the loan.

Bank Statement Program

Interest Rate and payments remain the same for the entire term of the loan.

Bridge Home Loan

Interest Rate and payments remain the same for the entire term of the loan.

Construction Home Loan

Interest Rate and payments remain the same for the entire term of the loan.

DSCR Home Loan

Interest Rate and payments remain the same for the entire term of the loan.

Fix & Flip Home Loan

Interest Rate and payments remain the same for the entire term of the loan.

HELOC Home Loan

Interest Rate and payments remain the same for the entire term of the loan.

Seller-Paid Buydown

Interest Rate and payments remain the same for the entire term of the loan.

Refinance

Mortgage refinancing may lower your monthly payments.

Cash-Out Refinance

Access home equity for various purposes.

VA Loan Refinance

There are two main ways to refinance your VA loan.

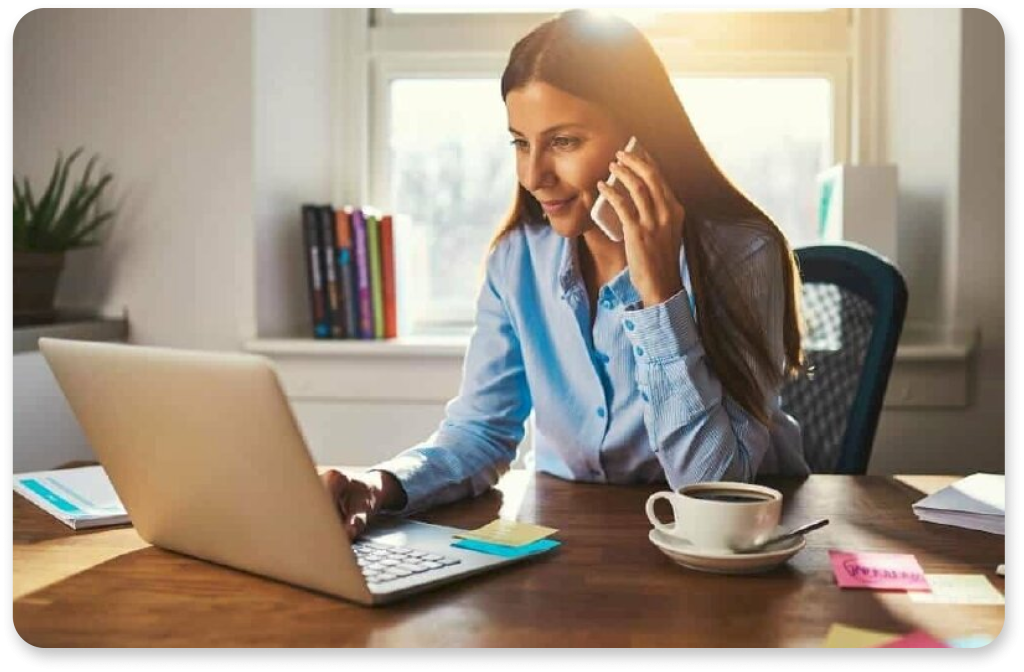

Get started today!

Complete the questionnaire on this page to begin a conversation about your mortgage needs today!

Contact Us Now! 888-870-5625

info@lockitmtg.com

Obtain Your FREE Pre-Qualification Letter!

Wondering how much house you can afford? Start by getting your FREE pre-approval today!

Need help? Call our mortgage expert team anytime at (888) 870-5625